do you have to pay inheritance tax in kansas

The tax due should be paid when the return is filed. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs.

Annuity Taxation How Various Annuities Are Taxed

States including kansas do not have estate or inheritance taxes in place as of 2013.

. Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. The estate tax is not to be confused with the inheritance tax which is a different tax.

Like most states Kansas has a progressive income tax. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Kansas Inheritance and Gift Tax.

If you live in a state without an inheritance tax you will not owe anything on the property simply because you inherited it. Kansas and Missouri fall into. The estate tax is not to be confused with the inheritance tax which is a different tax.

Currently there are only six states in the United. However if the beneficiarys net. These two states are maryland and new.

Up to 15 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. If you live in kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

Inheritances that fall below these exemption amounts arent subject to the tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Kansas inheritance and gift tax.

There is no federal inheritance tax but there is a federal estate tax. This gift-tax limit does not refer to the total amount you. Kansas has no inheritance tax either.

If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. At the federal level there is no tax on.

Kansas residents who inherit assets from Kansas estates do not pay an. States including kansas do not have estate or inheritance taxes in place as of 2013. Another states inheritance laws may apply however if you inherit money or assets from someone who.

State inheritance tax rates range from 1 up to 16. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount.

This is a tax on the value. Talking about less than the big. Not all states have an inheritance tax.

Many cities and counties impose their. Does kansas have an inheritance tax. Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances.

The state sales tax rate is 65.

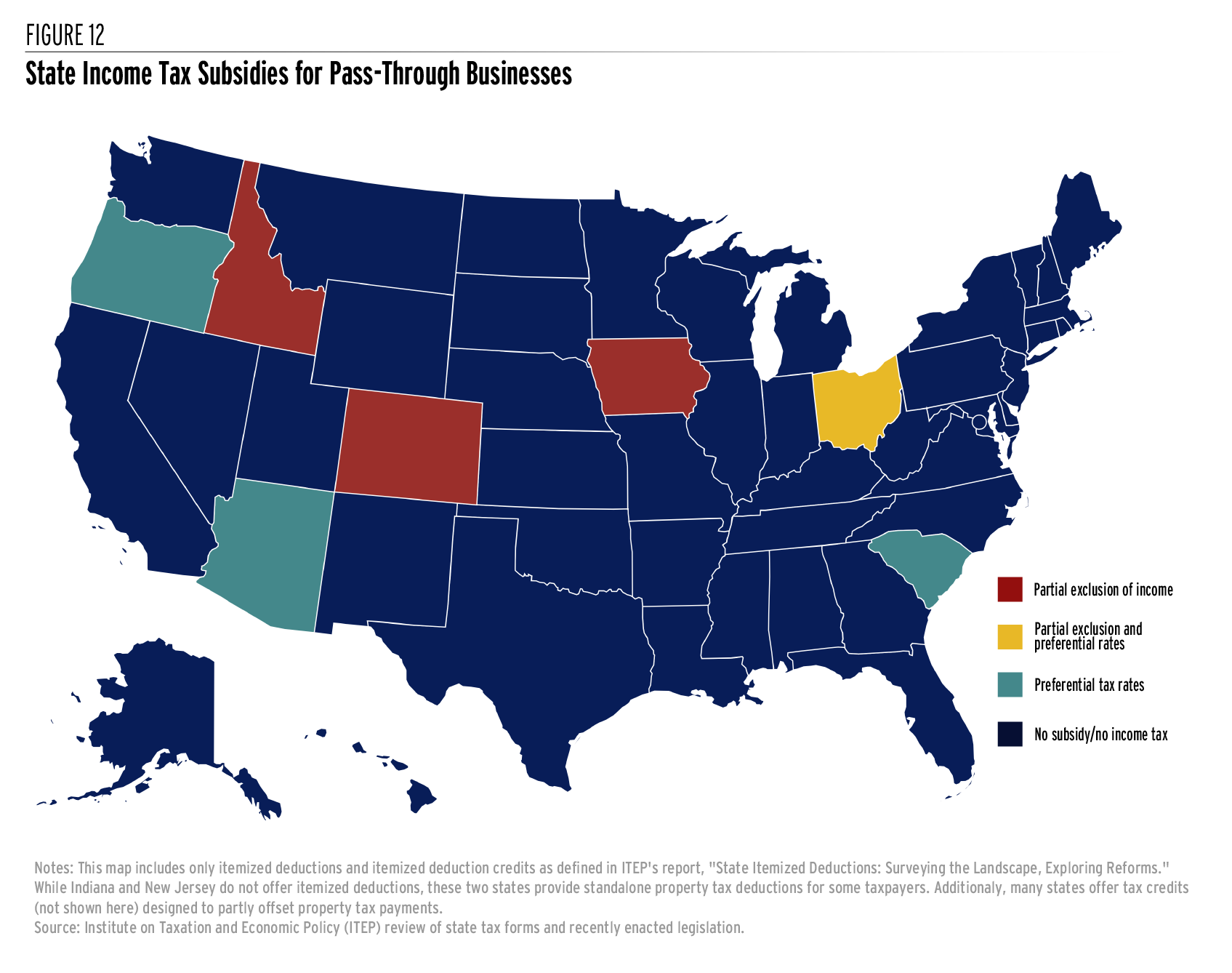

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

What Are The Inheritance Rules In The Usa Us Property Guides

Estate Tax And Inheritance Tax In Kansas Estate Planning

Will Attorney Bever Dye Trust Attorney Wichita Ks

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

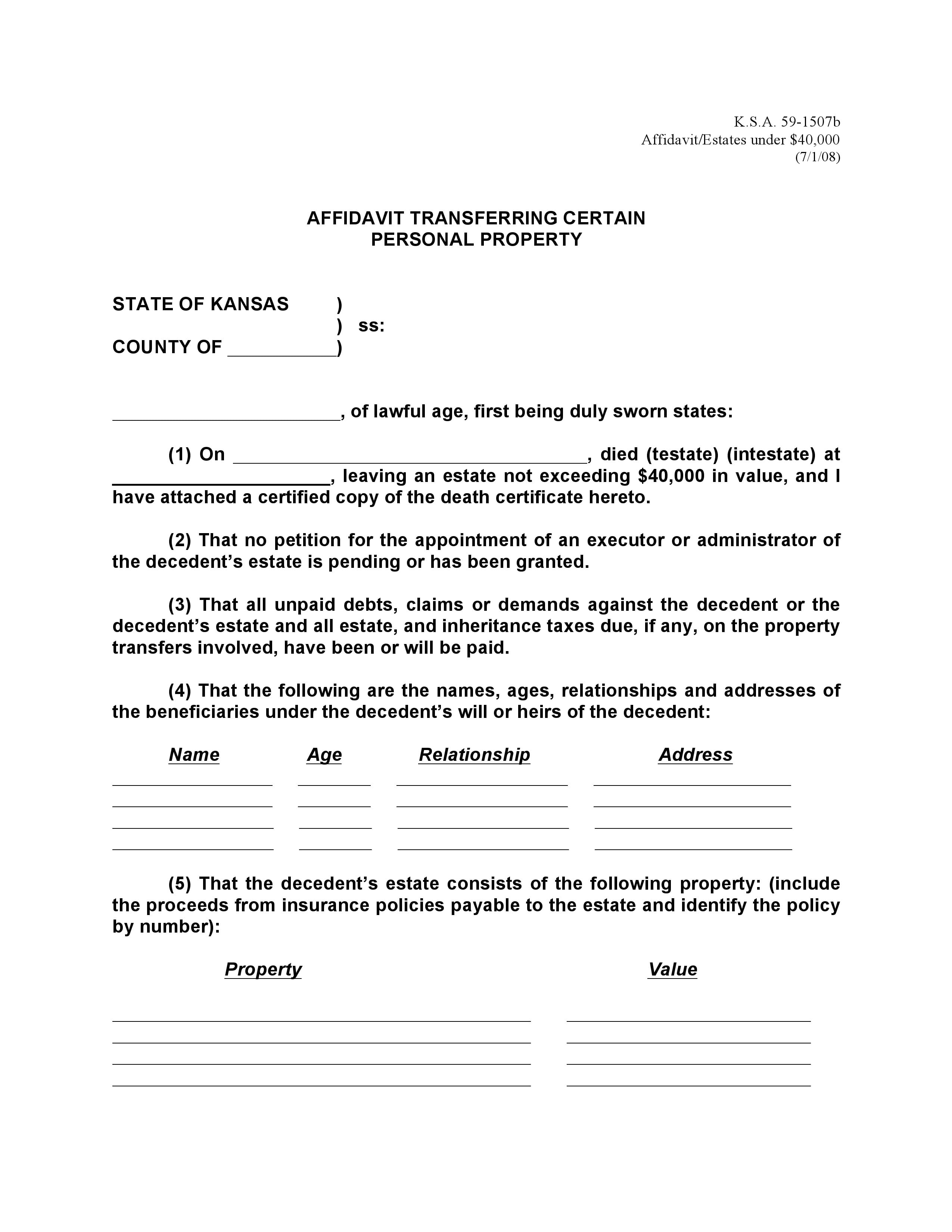

Download Free Kansas Small Estate Affidavit Form Form Download

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How A Transfer On Death Deed Works Smartasset

Estate Tax And Inheritance Tax In Kansas Estate Planning

Annuity Taxation How Various Annuities Are Taxed

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

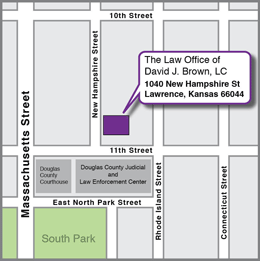

Wills And Trusts Law Office Of David J Brown

Kansas Estate Planning Attorney Talks About Safe Storage For Your Estate Plan

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Tax Understanding How Arkansas Texas And Surrounding States Impact Retirement Income Brownlee Wealth Management

Kansas And Missouri Estate Planning Revocable Living Trusts

Retirement Relocation Watch Out For Death Taxes Kansas And Missouri Estate Planning